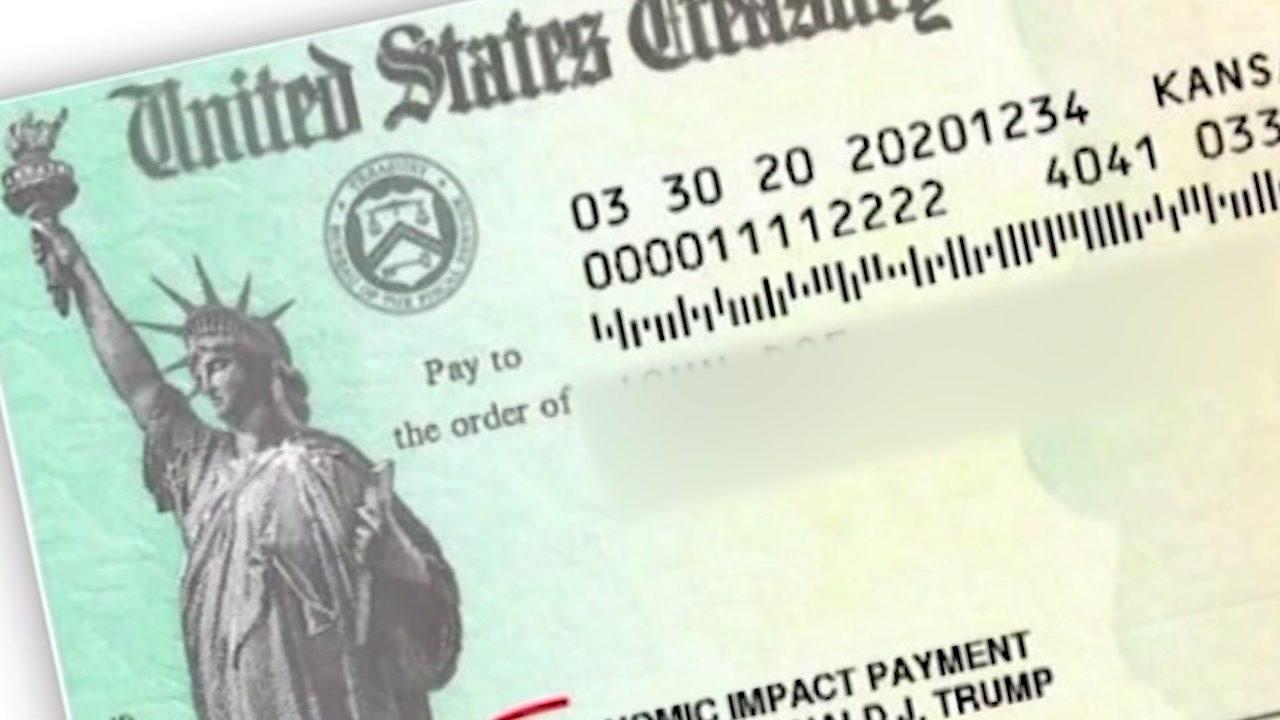

Your coronavirus stimulus check payment could come on a debit card in a plain envelope

Nearly four million people will receive their stimulus check in the form of a prepaid debit card, but some might not realize exactly what it is when it arrives in the mail.

The Treasury Department said Tuesday that the prepaid debit cards will come in a plain envelope from Money Network Cardholder Services.

There have been reports of some recipients thinking the card is a scam and even destroying it when it arrives. You can tell if the card is legitimate by making sure it includes a Visa logo on the front and MetaBank, the name of the issuing bank, on the back of the card.

The prepaid debit card will come with additional documentation identifying it as an economic impact payment card as well as information about how to activate and use it. More information is available at eipcard.com.

The government in April began sending $1,200 for each individual, $2,400 for each married couple and another $500 for each dependent child to families across the United States. Wealthier families get either a reduced payout or nothing depending on their income.

Those who were eligible to receive an economic impact payment may have previously received a direct deposit payment or a paper check in the mail. The Treasury Department only recently began issuing the prepaid debit cards to those without bank information on file with the IRS whose tax return was processed by either the Andover or Austin IRS Service Center.

Approximately 8.4 million U.S. households were considered "unbanked" in 2017, meaning that no one in the household had an account, according to the Federal Deposit Insurance Corp. Another 24.2 million households were "underbanked," meaning they might have a bank account but members of the household also used an alternative financial service for money orders, check cashing, international remittances, payday loans and pawn shop loans, often at high costs.

The Associated Press contributed to this report.