CA unemployment: Why is Bank of America draining EDD bank accounts?

Bank of America has been draining money out of countless EDD accounts, leaving many Californians bewildered and without any money.

California's Employment Development Department is fighting rampant fraud -- but in the process, many unemployed workers say their accounts are frozen and their money is suddenly gone.

It's a bit like "shoot first, ask questions later."

Bank of America has been draining money out of countless EDD accounts, leaving many workers bewildered and without money.

Michael Covant of San Francisco lost his job as a bellhop when hotels were forced to close in the pandemic.

RELATED: EDD mistakenly takes $10,000 from SF man's account in attempt to fight suspected fraud

It took months to get his EDD benefits, and when he finally did, the bank took them right back.

"Literally I've been betrayed by EDD," said Covant. "The most frustrating part is everyone telling me everything's okay when it's not okay."

Covant discovered something was wrong when he used his EDD debit card to order a pizza and suddenly the card didn't work.

"So then I called Bank of America first to see why the card was suspended. They said, 'Oh, only EDD can do that, contact EDD.' So I contact EDD, they say, 'Oh, only BofA can do that.'"

When he called the bank again, he said the agent was stunned at what he saw.

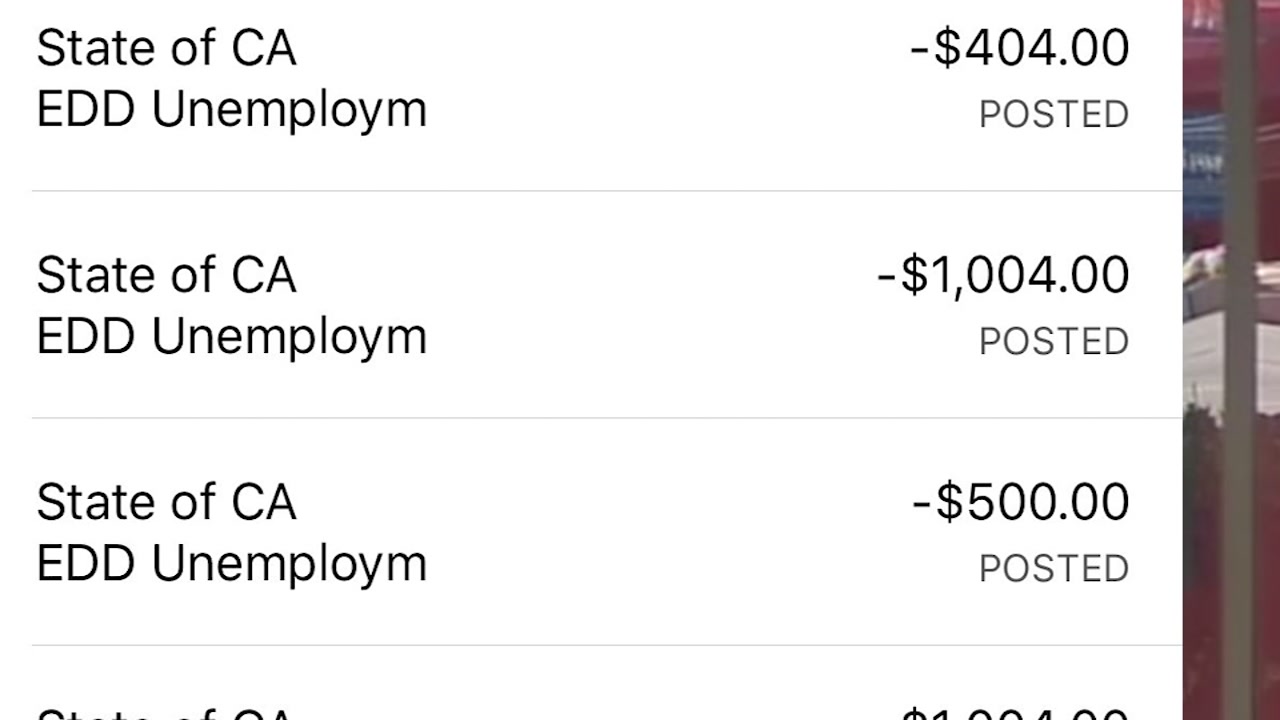

"They said, 'Whoa, whoa. The EDD is pulling out the amounts transaction by transaction by transaction,'" Covant recalled.

Here's what KABC-TV's sister station, KGO, saw: the EDD was pulling Covant's benefits back out of his account, one chunk at a time until all $16,000 was gone.

"He said, 'In my 25 years of banking I've never seen anything like this.' He was as bewildered as I was," Covant said.

Covant saw KGO-TV's earlier report about Anthony Serafino of San Francisco. The EDD pulled $10,000 out of his account one payment at a time too.

Now, viewers all over the state tell KGO-TV that Bank of America is draining their EDD accounts.

RELATED: Homeless NorCal mother living with 4-year-old son in her car finally receives EDD benefits

Covant says EDD and the bank offered him no explanation.

"You guys took $16,000 from the account. Where did it go? From their end it was they didn't know what I was talking about," he said.

Bank of America tells KGO-Tv it is removing funds from some EDD accounts due to suspicious activity on the cards.

In Covant's case, he reported his original EDD debit card was stolen in the mail. A thief ran up $16,000 in charges.

Bank of America restored the fraudulent charges weeks ago, only to take all that money back now.

RELATED: Thousands of California EDD unemployment cards frozen due to suspicious activity

"There is nothing in there. They left nothing," Covant said.

Bank of America said customers now must contact the bank and try to claim that money back.

The bank issued a statement, saying in part:

"The action was part of our broad effort to fight fraud. There has been billions of dollars of fraud during this pandemic in state unemployment programs, including California. We are working with the state and law enforcement to identify and take action against fraudulent applicants, protect taxpayer money and ensure that legitimate applicants can access their benefits.

We notified affected cardholders of this action and encouraged them to contact us if they believe the credit should be reinstated."

Covant says he's been trying for weeks and getting nowhere.

"Why am I being caught up in this form of this now? There's emotions that go behind that. You feel... cheated, more or less," he said.

KGO-TV got the bank to replace Serafino's $10,000 and is now working with the bank and state legislators to help Covant. If you've had this happen to you, let KGO-TV's 7 On Your Side know about it.